Ownership Matters

Over the last 75 years, South Bend has been at the center of two quintessential stories of change in the industrial Midwest: first, Studebaker in the 1960s, and later, South Bend Lathe in the 1970s.

They’re usually told as stories about workers, pensions, strikes, and shutdowns. But hidden in both, there’s a quieter, but equally important theme - ownership. And when you zoom out with that lens in mind, you can see the draft of a compelling story taking shape. Two acts of three already penned, one waiting to be written.

Act One: Studebaker

By the 1960s, Studebaker was no longer the family company it once was. As Andrew Beckman of the Studebaker Museum explained:

“The Studebaker family wasn’t involved in the company much after they went public in the early teens… outsiders came on to the Studebaker board, money interests. Lehman Brothers, other banking houses got on Studebaker’s board. The family essentially withdrew from the company at that time.”

That increasing distance, over decades, shaped what came next. On December 9, 1963, the Tribune ran the headline: AUTO OUTPUT TO END HERE. The ‘official’ announcement was scheduled the next day in New York, but word had already spread outside Gate 1 on Sample Street.

The losses were devastating: thousands of jobs and ultimately the pensions that workers were promised. UAW researchers warned:

“I am advised that the average age of the South Bend Studebaker workers is 54 and that it is unlikely that the pension fund will have sufficient monies to pay pensions to workers under 60 years of age.”

Studebaker became a national case study. As historian James Wooten later wrote, “Studebaker became a poster child for the cause of pension reform and… termination insurance moved squarely onto the policy agenda.”

Almost 10 years later, ERISA was passed, the company oft mentioned as inspiration.

Act Two: South Bend Lathe

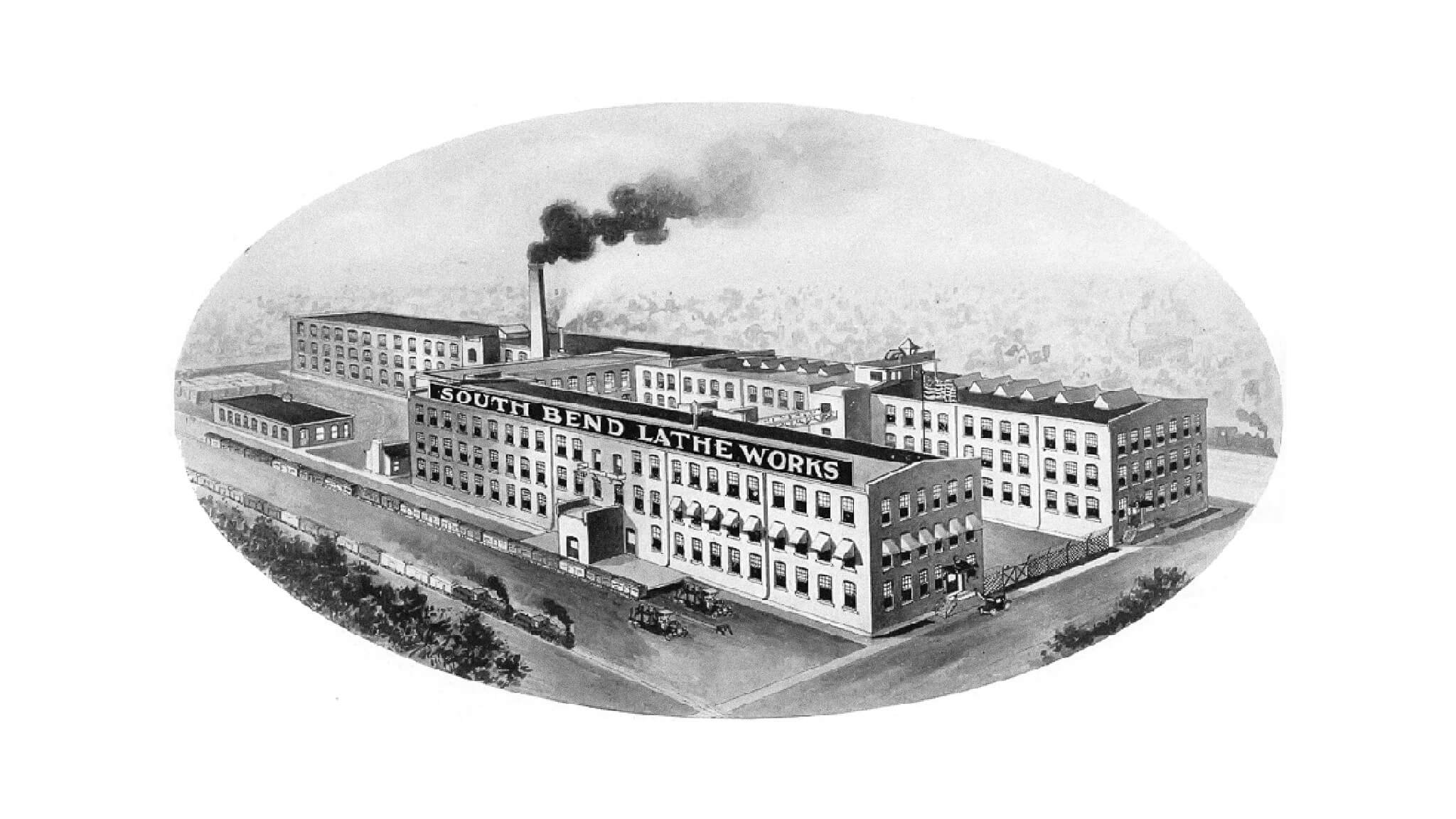

In 1975, it was a different company, but a familiar problem. A once-local company, South Bend Lathe, was slated for liquidation by its owner, Amsted Industries, a Chicago conglomerate. The company was nearly 70 years old, world-famous in its industry, and employed almost 500 people.

This time, the signs were caught before it was too late. A federal-municipal partnership, local banks, and a newly-legislated employee stock ownership plan (ESOP) stitched together a unique buyout. Ironically, it was ERISA, the legislation inspired in part by Studebaker, that made it possible.

The experiment drew national attention. TIME magazine ran a story titled More Worker-Owners. The Wall Street Journal ran How and Why U.S. Helped 500 Workers Take Over a Machine-Tool Manufacturer. For a moment, it was the model for a new worker-centric capitalism.

But inside the plant, it felt different. Five years later, a Washington Post article titled, Workers at Employe-Owned Firm Find the Going Rough, would quote a machinist:

“I did what I did back then just to save our job. I didn’t know a damned thing about ESOP, other than that it would keep the plant going and the paychecks coming. I figured we could wait until later to work out the kinks in this ownership stuff.”

After an initial few years of improved performance and profitability, the company struggled to find its footing and reorientate its traditional management-labor dynamic into that of a collectively-owned firm. In 1980, it reached a breaking point and workers went on strike against the company they owned. What had once been a poster child became, as one of the architects of the deal put it, “the bête noire of the ESOP movement.”

Act Three: [Unwritten]

Ownership determines who decides, who benefits, and who survives. I think it’s the most underused, under-leveraged, and under-appreciated tool of economic development today. It should sit alongside tax incentives, talent attraction, workforce development, and all the other strategies being deployed. I’m not just talking about employee ownership - I’m talking about ownership in general. It’s a tool that can take many forms, used in many ways, and deserves attention and innovation.

South Bend, and cities like it, have an opportunity to write the next act.

Studebaker showed the tool of ownership go ignored, except in retrospect.

South Bend Lathe showed the tool of ownership used, but reactive.

What happens when the tool of ownership is used to build resilience?